-

NZ’s Leading Car Finance Provider

Fast Approval. Apply Online Now!

Get a Fresh Start From $50 a week

-

NZ’s Leading Car Finance Provider

Fast Approval. Apply Online Now!

Get a Fresh Start From $50 a week

-

NZ’s Leading Car Finance Provider

Fast Approval. Apply Online Now!

Get a Fresh Start From $50 a week

Why choose CarFinance2U to get your car loan TODAY?

When it comes to car finance, we know it can be confusing with many questions about the different options available for new or used car purchases. Our CarFinance2U website guides you through the process to make purchasing your new vehicle as simple as possible. With any finance product there are several different options to consider depending on how much you want to borrow, how much you've budgeted for monthly payments and also the contract period. At CF2U we'll help you through the process. Think of our sales consultant as your personal assistant who will be there with you every step of the way.

Get a car loan for virtually any car from any dealer in NZ even if you have bad credit

Decisions within 30 mins. Get approved now and drive away with the car of your dreams in no time.

-

Apply for your Car Loan Today

Get a Fresh Start From $50 a Week. Any Credit or Car. Fast Approval!

Easy and Quick Car Loans

If you are in the market for a NZ car loan then you've come to the right place. Find the very best deal on your new vehicle purchase through CarFinance2U. Get pre-approved today with our simple online form. Get approved even if you have had a bad credit car loan in the past.

- Apply Now. It take less than 5 minutes

- Our team could get you an approval in 30 minutes

- Choose your car and drive away today

Second Chance Car Loans NZ

One of the more frequent questions we get asked at CF2U is whether we can help customers get pre-approved for a new or used car loan even with bad credit. In most cases, the answer is YES.

We can typically help with the following:

- Bankruptcy

- Mortgage arrears

- Defaults

- Judgments

- Late or missed payment(s)

-

We can help with Bad Credit Car Loans

Car Loans for Bad Credit. Apply Now.

Fast Approval For Your Dream Car

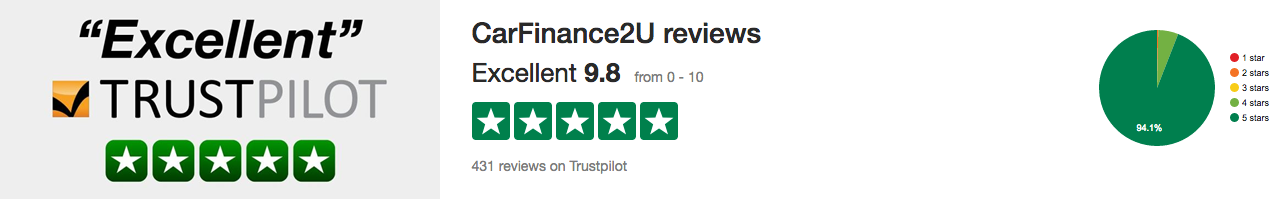

CarFinance2U Customer Reviews

Awesome Company!

I was super-impressed with Anna Barber, she was very efficient and determined to make sure I was successful in my application. I would highly recommend CarFinance2U for anyone looking for car loans. Very happy customer and look forward to continuing with using CarFinance2U. Well done!

– Tu Chapman

Excellent Service

This was the easiest, stress-free experience I've ever encountered with the best customer services ever. Everything was completed online and the emails/texts/phone calls were always helpful and friendly. I applied on Monday and picked up my new car the same week. Thank you so much for all your help and a huge heartfelt thanks to Rene Johnson for providing outstanding customer service throughout this process, you are definitely an asset to your company. Thanks again!

- Anne Fiame

AWESOME!!

Thank you guys so much for allowing me to get a new vehicle. I was dealing with Jane who is super awesome. She would always call every 10 mins either reminding me about something that I had to do or just letting me know whats happening. Thank you so much for what you have done. Ill recommend CarFinance2U to anyone. Big smiles all around!

– Tawera Edwards

Instant Online Decisions

With decisions available in less than 30 minutes – why wait? At CF2U we can even help with bad credit car loans. Get approved NOW!

Bad Credit Car Loans

If you are looking for a new car but have bad credit we can still help as we cover most credit levels.

Any Car Any Dealer

With CF2U you can purchase your car from any dealer, anywhere in NZ, including Trade Me, Turners Auction

Car Finance Questions

-

-

At CF2U we see car loans and car finance as being the same thing. Traditionally, car loans were provided by banking institutions whereas car finance was arranged by non-bank lenders. As NZ's leading online brokerage we make the process of getting you into a new car as simple as possible.

-

-

-

The great thing about coming to CarFinance2U for your vehicle finance is that you are able buy your new car from online sites such as Trade Me, Autotrader, Autobase and many more. This also includes car dealers and private sellers.

-

-

-

In short, the answer is 'No'. We are able to finance vehicles from most car dealerships, private sellers and websites. The only conditions we have are that the car be registered in NZ and is acceptable to our finance providers.

-

-

-

When you get approved with CarFinance2U you can virtually choose any car from anywhere in NZ. We can even arrange delivery. Simply tell your sales consultant what you need and they will do the rest.

-

-

-

Once you're approved, your dedicated sales consultant is there to help you through every step of the process of getting your new vehicle. If you have one in mind, just let them know. If you are unsure they can search for the right vehicle to meet your needs.

-

-

-

At CF2U we have access to over 10 lenders throughout the country. This means that we can get the leading interest rates in NZ for our customers and their specific needs.

-

-

-

Once you're approved and you've found the right car, we'll email you your contract and all you have to do is sign and return it to your sales consultant. They'll check to make sure everything is in order and arrange for the funds to be paid to the seller.

-

-

-

At CarFinance2U we operate entirely online and so this means all you need to do is fill in the online application form. One of our sales consultants will contact you and help you through the process to have you in your new car in no time.

-

-

-

At CarFinance2U we can arrange lending from $5,000. The maximum loan is determined by what the customer can afford.

-

-

-

You will need to be at least 21 years old to be eligible for one of our car loans. If you have a guarantor, we can consider someone who is younger.

-

-

-

Yes a valid NZ learner's licence is acceptable for starting a loan application with CarFinance2U. We will also accept a restricted licence and obviously a full licence too.

-

-

-

Decisions can be reached within 30 minutes once we receive the information we need from you.

-

-

-

Once you've been approved and have found a vehicle that meets the lender's requirements the money can be transferred to the seller in as little as 60 minutes.

-

-

-

With our online systems we can provide an instant appraisal and confirm that you've been approved within 30 minutes. Special cases my take longer.

-

-

-

Our online process is really quick and simple. Complete the online application form and one of our sales consultants will contact you. Then send through 30 days of bank statements and a copy of your driver's licence. Once you're approved you can choose a car up to the agreed amount. We can then send you a digital contract for you to complete on your mobile, laptop, desktop or tablet. We will then arrange payment of the funds into the seller's bank account and you can pick up the vehicle. It couldn't be easier!

-

-

-

A guarantor might be requested if your affordability is low or you have had bad credit in the past. Applicants under 21 may be asked to provide a guarantor to improve their eligibility.

-

-

-

CF2U loans typically range from 3-4 years. However, as every customer is different we can often arrange finance to suit whatever length of borrowing you need.

-

-

-

With the majority of our funding options you can choose to make your repayments either weekly, fortnightly or monthly depending on what suits you.

-

-

-

CarFinance2U is authorised by a number of NZ's leading insurance providers. Popular products include Mechanical Breakdown Warranty, GAP Insurance Cover, Payment Protection Insurance and Motor Vehicle Insurance.

-

-

-

With most cases we require a copy of your current driver's licence along with your last 30 days' bank statements to confirm your salary.

-

-

-

Each of our funders is different but at a minimum we will need 30 days of bank statements and a valid driver's licence. In certain instances we may require proof of address and/or information on any current or historic loans you may have had.

Valid NZ driver's licence for identity

Proof of address such as phone or utility bill

Pay slip or bank statement to show income

-

-

-

It is possible to get approved with no deposit but it will depend on your credit profile amongst other factors.

-

-

-

Yes, we can arrange your car loan with zero deposit.

-

-

-

We aim to help all of our customers so even if you have already been declined for finance in the past or recently at a local dealership we will more than likely be able to help. Our panel of lenders includes several sub-prime companies that will approve those with bad credit on their file so please don’t let this put you off.

-

-

-

A bad credit car loan works in just the same way as a typical loan in that you request an amount of money for your purchase and also the term in which you wish to repay the balance. Our specialist underwriters will assess your case and ensure it is matched to the right lenders. After all, what’s the point in saying we can do something if we can’t? By ensuring your profile is right for the lender you stand a much greater chance of being approved and it also reduces the number of needless credit searches carried out on you! Previous problems are not going to get you instantly declined either as we are well aware that applicants for this type of finance will have had some problems in the past.

-

-

-

Once you have completed the online application form on our website we simply need you to email 30 days of bank statements and a copy of your driver’s licence.

-

-

-

It might be that you had problems several years ago or that you forgot to update your contact details when you last moved address. At CarFinance2U we can usually get our customers approved even if they have defaults. Obviously it will make a difference if it was only a couple of weeks before you applied but our lenders look at the merits of each case. If you have a repayment plan in place this can help and the more information we have the better.

-

-

-

With our car loan for bad credit products, each case is different and so this means even if you have already been turned away from your bank or another lender we can still help. Our expert team can usually identify any possible questions once your application is completed. Also by working with a panel of lenders we are able to have many more options for you compared to typical car loan companies.

-

-

-

Yes – we operate with a number of specialist funders in NZ and so are well placed to help all customers to drive off in the car of their choice.

-

-

-

Once we have you pre-approved for your car loan, the great news is you are free to choose any car you like from car dealers and private sellers. This means you are free to use Trade Me and select your car from the comfort of your own home while we take care of everything else.

-

-

-

Providing you have been discharged from your bankruptcy or NAP, we stand a very good chance of getting your case approved. We have found that customers who apply actually have a better current standing than say someone with just defaults. This is because the recorded defaults have been cleared and the applicant often has no further financial commitments as a result.

-

-

-

No – while we can offer a very high approval rate for those with poor credit ratings we are completely different to Aqua Cars. With CarFinance2U you are free to pick your own vehicle as we are in the business of finance brokerage and not car sales.

-

-

-

We certainly can! Many of our customers approached MTF prior to coming to us. Our panel of funders covers virtually all levels of credit so while lenders like MTF only have one option, with CF2U we can match your application to one of our many lenders.

-

-

-

As part of responsible lending our underwriters will always require a credit check for applications. At CarFinance2U we offer a fresh-start finance approach. Your credit check is used to confirm items such as your address for security and any defaults you may have.

-

-

-

Yes, we can arrange additional borrowing on your new car loan to help pay off current commitments such as loans with providers like Finance Now.

-

-

-

Yes – we can simply get you pre-approved for a new loan and then once you pick your new car and a trade-in price has been agreed with the dealership, we can settle the difference owed to Avanti Finance for you.

-

-

-

Being an online business we can offer our services across NZ without seeing you face to face. We have virtual offices in Auckland, Wellington, and Christchurch. We are headquartered in Gisborne so if you're in the neighbourhood, please drop in.

-